Private Credit: Pricing and Opportunity

One of the core holdings in our alternative investment allocation is to private credit. We invest in this area through various diversified funds managed by some of the most experienced and respected managers in this space. We are fortunate to have a collaborative relationship with these managers.

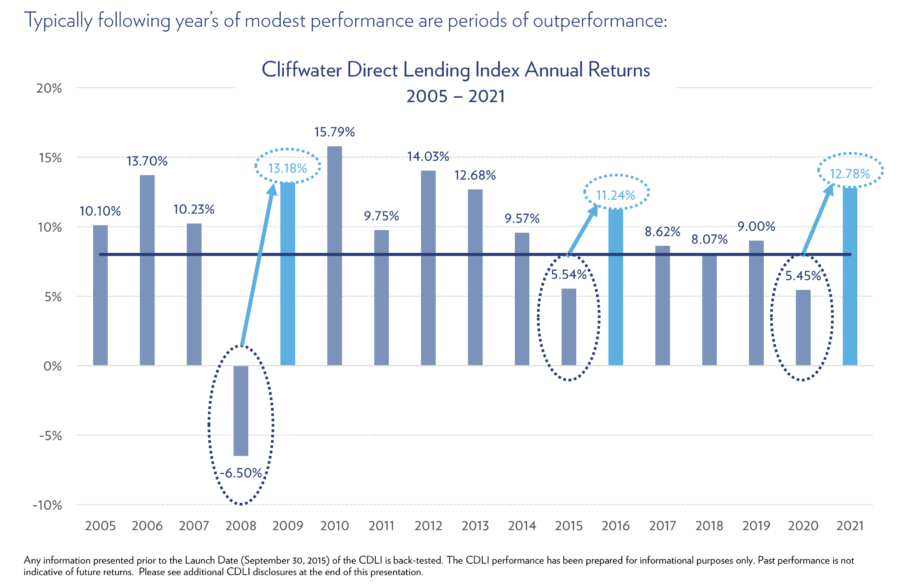

The current market dynamics of private lending have created an attractive investment opportunity for this category. To understand this dynamic, it’s important to first remember how the returns of these investments are calculated. Private credit returns are determined through a simplistic calculation. First, net income is the “top line” return. Net income is the interest earned on the loans and is often a floating rate. From there, a few adjustments need to happen including a deduction for fees, a negative adjustment for realized losses (loans that actually experienced a default), and an adjustment for “unrealized gains/losses”. Unrealized gains/losses allow the portfolio manager to mark the value of the portfolio to given market conditions. During times of uncertainty, values are typically adjusted down to reflect the possibility of higher default risk. Historically, managers overstate these risks, which later leads to a “write up”, or adjustment higher, as an “unrealized gain.” In the past, this dynamic has caused years of underperformance to be followed by periods of outperformance. The following chart shows this:

2023 Outlook

As a result of unrealized losses, 2022 was a period of “underperformance” with the index returning around 6%. Does this mean 2023 will follow the recover trends shown in 2009, 2016 and 2021? There is strong evidence that would support this. First, expected income for 2023 (the top line income number) is between 11-12%. This is the highest “start” level in recent history. Any “unwind” of overstated unrealized losses will add to this top line income, thus increasing the total return. The risk to these results would be an increase in realized losses. This could happen if the economy goes into a deep and prolonged recession (not our current base case).

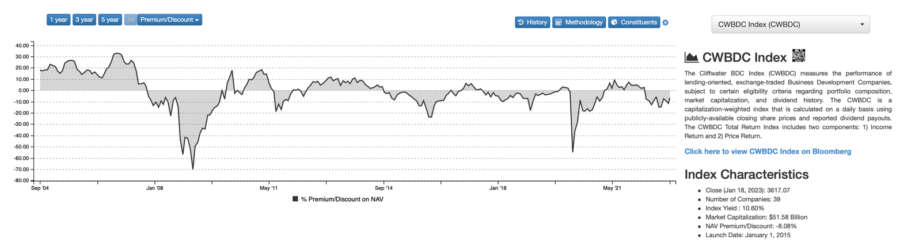

One indicator to watch is the market’s pricing of publicly traded business development companies (BDCs). These public companies lend in a similar fashion, although with higher risk, to the private credit funds we use. During times of stress, the market price of BDCs will decline, often substantially, to reflect the potential of future defaults. These drops cause the company’s market value to drop below the net asset value of the fund’s assets (NAV). For example, a 30% discount would reflect a market price that is 30% below the value of the loans. During the financial crisis of 2008, discounts were as high as 70%. During Covid, discounts dropped below 50%. Today, the average discount is 8% (see chart below). Higher quality BDCs (companies more similar to the funds we invest in) are mostly trading at premiums. Although there are no guarantees, this can be seen as evidence that the market is not currently assuming a high number of defaults for private, secured loans. Assuming this indicator proves to be correct, 2023-2024 should reward investors in private credit with high starting yields PLUS additional price appreciation due to unrealized gains. It would be possible to see returns in the 12-15% range (on the high end) with what should be a low risk for losses over this same period.

What is the Market Currently Telling Us?

DISCLOSURE

The views expressed herein are the views of Watts Gwilliam & Co, LLC and are not intended for public use or distribution. It may not be copied, transmitted, given, or disclosed to any person other than those to whom it was directly distributed to. This is being distributed for informational and discussion purposes only, should not be considered investment advice, and should not be construed as an offer or solicitation of an offer for the purchase or sale of any security. This writeup is not meant to be, nor shall it be construed as, an attempt to define all information that may be material to an investor. The information herein does not consider any investor’s particular investment objectives, strategies, tax status or investment horizon.

The information contained herein is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve.

Statements that are nonfactual in nature, including opinions, projections, and estimates, assume certain economic conditions and industry developments and constitute only current opinions that are subject to change without notice. Further, all information, including opinions and facts, expressed herein are current as of the date appearing in this presentation and is subject to change without notice. Unless otherwise indicated, dates indicated by the name of a month and a year are end of month.

All third party information has been obtained from sources believed to be reliable but its accuracy is not guaranteed. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this presentation. Watts Gwilliam & Co. LLC shall not be responsible for investment decisions, damages, or other losses resulting from the use of the information herein.

There can be no assurance that any expected rate of return, risk, or yield will be achieved. Rate of return, risk, and yield expectations are subjective determinations by Watts Gwilliam based on a variety of factors, including, among other things, investment strategy, prior performance of similar strategies, and market conditions. Expected rate of return, risk, and yield may be based upon assumptions regarding future events and conditions that prove to be inaccurate. Expected rate of return, risk, and yield should not be relied upon as an indication of future performance and should not form the primary basis for an investment decision. No representation or assurance is made that the expected rate of return, risk, or yield will be achieved.

Past performance is not indicative of future returns, which may vary. Future returns are not guaranteed, and a loss of principal may occur.