Why Diversification is Important: Financial Advisor in Gilbert Explains

As financial advisors in Gilbert, AZ, not having a properly diversified investment portfolio is one of the common personal financial planning mistakes we see DIY investors make. They think they understand the concept, but either don’t really or are diverted by emotions.

When done correctly, diversification is a technique that reduces risk by allocating investments across different financial instruments, industries and other categories. In other words, it’s the act of spreading your wealth across multiple asset classes and securities, so that when one dips, your portfolio as a whole doesn’t suffer.

Depending on your strategy, some investments may even counteract these dips and keep your portfolio value relatively stable. For example, bonds typically move in the opposite direction of stocks. So, when the stock market takes a tumble, bonds rise in value and help soften the blow.

The concept may seem simple enough, but did you know that there are 2 types of diversification? Many DIY-ers don’t. When you have a lot of money invested, losses can be especially devastating. This is just one of the reasons why it’s prudent to turn to a financial advisor for help.

Two Types of Diversification

There are two main ways to diversify your portfolio.

First, you can diversify across multiple asset classes (this is also known as asset allocation). These could be stocks, bonds, cash, cash equivalents, real estate, commodities, precious metals and even cryptocurrency.

Instead of pouring all your money into stocks, you’d spread it out across these other asset classes because each reacts differently to market conditions.

Secondly, you can diversify within each of your asset classes, owning as much variety as you can within each category. For stocks, this may mean investing in large companies and small companies; emerging markets, varying industries, growth stocks, dividend stocks and so on.

Why is Diversification Important?

Diversification is important because you can’t time the market. You can’t predict what will be hot one minute and cold the next – even financial advisors get it wrong. You also can’t avoid stock market volatility.

Diversification gives you the best chance of succeeding in the stock market long-term. However, it doesn’t guarantee against losses, and you can never fully eliminate investment risk.

Investors end up with poorly diversified portfolios for many reasons. One common personal financial planning mistake is maintaining a set-it-and-forget-it mentality and never reviewing your financial plan. When markets change and your portfolio becomes unbalanced, it’s important to review your plan to make sure it is still in-line with your risk tolerance. (Do you know what your true financial risk tolerance is? Find out now.)

Another common personal financial planning mistake is holding over-concentrated stocks for too long. At Watts Gwilliam and Company, we specialize in managing these situations. Read our recent blog post: How to Turn Concentrated Stock Holdings into Income Generators.

Investment management is more complicated than you may think. Contact Watts Gwilliam and Company to see how we can help.

The Dangers of Not Diversifying When You Have a High Net Worth

Diversification is especially important for high-net-worth individuals, such as professional athletes and high-income-earning business owners, because the more you have, the more you have to lose.

For example, let’s say you have a $5 million portfolio. You own a few different securities, but 50 percent of your holdings are in the tech sector. (That’s $2.5 million.)

Now, let’s say the tech sector experiences a 20 percent dip overnight, which is totally normal and likely to happen once every seven years).

On paper, you’ve suddenly lost half a million dollars in your portfolio!

Even if you’re diversified in 10 to 15 different tech stocks (in this example), they’ll likely react the same way to certain market conditions, because they’re in the same sector.

While these losses are only on paper, often times what happens is investors get spooked by the sudden dip and sell, which locks in any losses. A loss can be even harder to recover the closer you get to retirement.

How Time Factors into Diversification

Remember, diversification alone won’t save you from stock market volatility. You can diversify into 100 different stocks, but if all of those stocks are in the same market, your portfolio may still be at risk if that market takes a hit. Which is why asset allocation is also important – AKA, the other type of diversification.

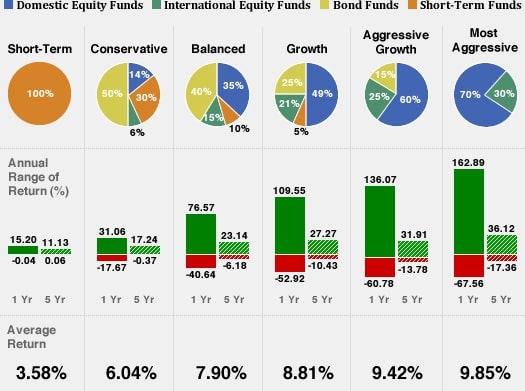

Asset allocation varies based on your age, goals and time horizon.

For example, when you’re young, you may have decades to let your wealth build until you retire. For this reason, you may choose a more aggressive portfolio that’s targeted for growth and mainly made up of stocks. As you get closer to retirement, however, you may want to adjust your asset allocation to be more conservative.

Getting your asset allocation just right is a delicate dance. Are you up for the task on your own? If you have a lot of money to invest as well as a list of financial goals you’re trying to reach, don’t be afraid to ask for help! Not seeking help is another common personal financial planning mistake – and a common financial planning mistake you can avoid!

Let’s talk! Our financial advisors in Gilbert, AZ can help you strike the right balance in your portfolio.

Examples of Diversification

The table below highlights hypothetical portfolios with various asset allocations. You can see that these portfolios aren’t just weighted in stocks, bonds and short-investments. They’re broken down even further into U.S. stocks and foreign stocks, which is one form of diversification.

Need Help Diversifying Your Wealth?

Although you can never fully eliminate risk from your portfolio, you can minimize it with proper diversification. This includes not only diversifying among different asset classes but also diversifying within each of those asset classes.

At Watts Gwilliam and Company, our financial advisors in Gilbert, AZ are passionate about helping you reach your financial goals, through proper diversification and asset allocation, as well as other financial planning strategies. The key is to strike a balance between risk and return, so you can sleep at night while still being on track to reach your goals.

If you’d like help managing your portfolio, charting out your financial goals or even strategizing ways to minimize taxes, schedule a complimentary meeting with our team today. Together, we’ll go over your full financial picture and make recommendations for how you can accomplish your goals.