Holding Concentrated Stock Positions? Generate Revenue with Watts Gwilliam’s OPTIC Strategy

“Covered call writing can help you generate income on your existing stock holdings… but options can be complex and intimidating. We’re proud that our OPTIC program allows us to bring this powerful strategy to our clients efficiently.”

By Brad Gwilliam

A concentrated portfolio can increase potential gains under favorable conditions. However, it can also increase your risk at times. So, diversification is vital to successful investing.

There is nothing inherently wrong with owning a significant stock position. In fact, an allocation of assets that is slightly diversified, yet chiefly focused on a few high-quality types of investments is probably ideal.

It is possible to own a diversified portfolio while holding a concentrated position, too. Maximizing the return off the concentrated position will boost the overall portfolio return

As a result, we developed our Options for Income Creation (OPTIC) program. The OPTIC program will help you get the most from your single stock position.

What Is the OPTIC Strategy?

Even in today’s markets, you can still generate income from large stock positions. In fact, these can present opportunities too good for a savvy investor to miss.

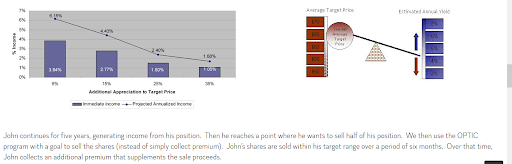

Did you know that only about 10% of option contracts get exercised? If a covered call ends up “in the money,” the strike price of the option is less than the stock’s current price. In other words, if it’s trading at $48 per share, call options of $47.50 or below will fall into this category.

When this happens, we have two choices: We can buy additional shares in the market to cover the call (sidestepping capital gain issues) or we can sell your existing stock. This is a rinse-and-repeat process.

Once an option has expired, we do it again, continuing the flow of income. It’s a simple process to discuss in these terms, but it still involves a large workload to accomplish.

Every time we write call options, someone has to research and analyze potential options. Next, the transaction must be done. The monitoring, meanwhile, remains an ongoing process.

Especially when all of this is done manually, it gets time-consuming. Thankfully, our OPTIC program was built to alleviate this problem.

How Does It Work?

OPTIC is more than just software. It’s a comprehensive model that facilitates streamlining this entire call-writing process. It allows us to make sure that everything is handled efficiently behind the scenes.

At the same time, it helps us ensure the maximum possible convenience for you. Once you set your parameters, your options get written precisely in accordance with your specifications. OPTIC does all the heavy lifting from there.

Using OPTIC allows you to retain voting rights and continue receiving dividends. If the stock’s price rises, you can still participate in some of the upside appreciation, as well.

You can realize all of your potential income with none of the drawbacks of the old process. We believe it is easier than ever before to benefit from concentrated stock strategies.

Who Benefits Most From Using It?

If you will forgive us for being candid, not every investor is an ideal candidate for OPTIC. In this case, one size does not fit all. A disciplined approach is required and this takes a special investor.

So, be careful. We recommend a reasoned, attentive approach to selling your options. The merits of an investment itself, alongside market conditions, should motivate your action.

However, taxes are also a consideration, too. Capital gains rates don’t have to ruin your day (or even your tax year), but when you own a large stock position, they must be factored into sales. They are an unavoidable part of the landscape. No place is tax-free.

OPTIC represents a great advance in many ways, but it is best used in conjunction with one of our advisors. Even the shrewdest investors are never 100% foolproof, so another pair of eyes never hurts.

Bottom Line

There are many quality financial advisors in Arizona, but one size does not fit all. We have been registered with the Securities and Exchange Commission since 2004—and we specialize in working with investors who have concentrated equity positions.

Whether you are looking to start a portfolio or you are between advisors, reach out and contact us today. We have a wide range of strategies for retirement accounts, mutual funds, and more.

Watts Gwilliam & Company is a fee-only, fiduciary financial advisory firm headquartered in Gilbert, Arizona and serving investors nationwide. Learn more about what this looks like and how we can help you create a financial plan that’s right for you.