Market Volatility, Inflation, Oh My! Challenges for 2022

Amidst economic chaos and life-altering losses, market crashes and lockdowns have swayed the way you live, work, and prioritize your time, health, and indeed wealth. Millennials have not experienced an inflationary period as adults, so this phenomenon is new to an entire generation.

Are you one of them?

Shockwaves of uncertainty plague the country since the COVID-19 pandemic entered the homes of every citizen like an unwelcome guest. Market volatility and inflation continue to dig deep into the pockets of high-net-worth individuals specifically.

Current conflict overseas is not helping the global COVID-19 recovery, but Arizona financial advisors can help you learn from any investment mistakes. Our Gilbert investment management firm, equips you with strategic financial planning through catch-up contributions, concentrated stock strategies, and creating retirement income.

And that’s just the tip of the iceberg.

Our complimentary eBook recommendation: Recession-Proof Your Life!

What are Market Volatility and Inflation, and What Does History Prove?

The similar economic devastation in the early ’80s taught us that inflation and market volatility can be planned for sure. It’s not a matter of if, but when; that’s why diversification is essential in investing.

The similar economic devastation in the early ’80s taught us that inflation and market volatility can be planned for sure. It’s not a matter of if, but when; that’s why diversification is essential in investing.

Let’s take a look back to a very similar recession:

Nearly two million people left the unemployment rolls. Inflation fell from 10.3% in 1981 to 3.2% in 1983. Corporate income rose by 29% in the July–September quarter of 1983, compared with the same period in 1982.

Now let’s compare that to the current recession:

From December 2019 to December 2020, 219 of 257 total private industries lost jobs, with only 37 sectors seeing job gains. The COVID-19 pandemic and the resulting lockdown caused 114 million people to lose their jobs over 2020.

Read: What Past Markets Tell Us About Volatility Alternative Investments

Inflation is the sustained upward movement in the overall prices of goods and services in an economy for a given amount of time. This correlates with a loss of purchasing power for a currency utilized within the economy. Essentially, you get less bang for your buck.

In what areas has inflation impacted your short-term and long-term wealth strategies?

Market Volatility refers to stock market uncertainty, which is influenced by interest rates, inflation rates, tax changes, and other fiscal policies. Still, it’s also affected by industry changes and global and national events.

Did you make any fear-based moves in response to the market crash and volatility?

Market volatility and inflation are inevitable. However, your financial advisor Gilbert firm assures – all hope is not lost. There is potential for wealth-building during these times. History shows that a volatile market will correct within two or three years.

Knowing how to invest is everything: read on to find out how.

What to Know About Market Volatility and Your Financial Plan

Learn Why Low Prices Can Be A Good Thing!

Learn Why Low Prices Can Be A Good Thing!

Volatility isn’t a bad thing if you know how to work its impacts in your favor! When times look and feel tough, a volatile market can provide exciting opportunities to invest. Under the surface of inflation, you could strike gold and make your money last a lifetime.

For example, if the general market impacts the price of a business to fall well below its actual value, you could pay less to buy the company now. When volatility forces this drop, you can buy it “on sale.”

When the price spikes on the opposite end of the volatility spectrum, you can quickly get a return on your money. Of course, every investment advisor will tell you to do your research. They will even help you ensure it’s a wise move.

Other Financial Plan TO-DOs:

- Diversify Your Portfolio Without Paying Taxes

- Find Out What It Really Means to Buy Company Stock

- Uncover What Percentage of Your Net Worth Should be Invested — Our 3 Buckets Will Tell You

- Learn About 10 Investment Mistakes Carrying Big Effects

- You Can Buy More For Less

Again, history proves that the volatile market will correct within a few years, which means your money can double or triple during that period. Watts financial services will help you make the big decisions, as you have shared your dreams and goals with them already. Right?

Retirement Planning in Troubled Times

Let’s not pretend that inflation supports wealth. It’s a retirement killer for most Americans who don’t have a solid financial plan in play. Retirement planning for high-net-worth individuals is essential during hard times.

Watts retirement wealth advisor suggests:

-

Don’t panic during a recession.

Fear-based moves might only dig you into an empty hole. Avoid sensational news to keep fear at bay. Consider your long-term goals before you make an investment decision. Take a step back to determine the cause of the panic – this can save you from making an ill-informed or emotional selling decision.

Call your financial advisor to understand what’s going on and plan on navigating these uncharted waters with caution, not fear. Good thing for you: Watts Gilbert retirement advisors chart this territory ahead of time and have strategies to help your retirement accounts stay full.

-

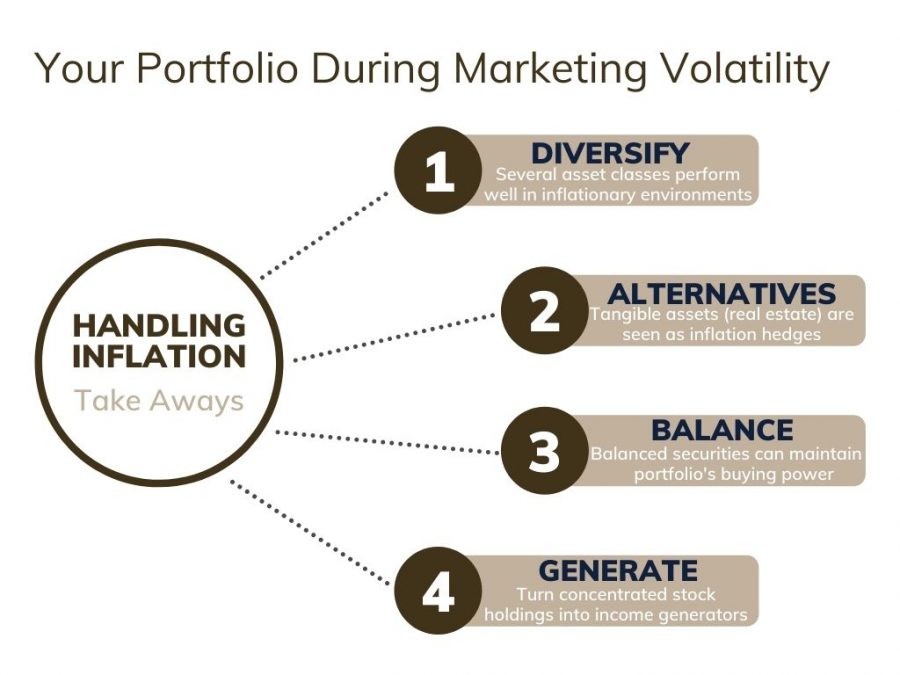

Diversify your holdings.

Failing to diversify your holdings makes your money vulnerable. Since the market consists of many asset categories, they don’t move in the same direction. So when one sector rockets, another plummet.

For example, in 2020, technology stocks soared, but oil stocks hit the ground hard.

Do you see why diversification is important in investing? Your portfolio needs considerable safety advantages, especially in any volatile market. Don’t rely on one financial resource. Diversifying your holdings provides numerous safety cushions so that the next downturn won’t feel so volatile.

Learn The Dangers of Not Diversifying When You Have a High Net Worth.

-

Rebalance your portfolio.

A healthy balance of investments can avoid over-concentration, which can help decrease your risk of losses. Inexperienced investors often become over-concentrated because they don’t review their portfolios regularly.

For example, say your investments in a specific stock, sector, or asset class perform very well. This investment will flourish more than others, throwing your portfolio off balance. Even though you’re reaping solid returns, it helps to rebalance your portfolio to ensure your over-concentrated position doesn’t wilt suddenly.

-

Make higher and automatic contributions.

A simple retirement planning trick for high-net-worth individuals and pro athletes is to increase your 401(k) or IRA contributions. Now, even a tiny percentage can make a big difference in your golden years. The longer your contributed money has time to grow, the better off you are. And the higher the amount, the more wealth you will accumulate.

If yours allows, sign up for automatic contribution increases annually. Or increase your contributions when you get a pay increase. You won’t even feel the difference.

The same applies to those who don’t yet have a 401(k). Saving $3,000 per month may not be feasible right now, but $500 or $2,000 might feel doable, which still compounds over time. Make small sacrifices and save your raise or tax refund.

-

Delay your retirement.

Give yourself more time if you can while markets are unsteady. Delaying retirement reduces the number of years your savings will support you. Waiting until full retirement age or later to claim Social Security can lead to higher benefits.

The Social Security Department says the Full Retirement Age (FRA) is now 67 for workers born in 1960 or later. You may also want to use their Retirement Age Calculator.

What You Should Know About Rule 72t and Early Retirement

Take A Look at Your Retirement Timeline

Download Your Retirement Checklist

Can I Retire Now: 5 Questions to Answer

-

Delay your social security until 70.

You can tap into Social Security when you turn 62, but your benefits increase the closer you wait until age 70.

For example, if your full retirement age is 66, you’d only receive 75% of your monthly benefit amount if you began withdrawals at the age of 62. You will get 132% of your amount if you wait until you turn 70.

Of course, this isn’t a stand-alone mathematical equation. However, if you can receive a higher monthly payment by waiting, it may not make sense for your financial situation. Retirement financial planning services are required, especially for high-net-worth individuals and pro athletes.

-

Look at alternate investments.

Many of our alternatives listed here can be risky business as a stand-alone investment. However, when initiated with professional financial advice, it can often increase returns and reduce the risk of your portfolio.

This is because of the diversification benefits they offer. Types of products Watts uses to diversify your portfolios include:

- Private equity – Private equity investments are made in companies not publicly traded. This requires income or net worth to invest.

- Private real estate – Real estate investing provides a chance to diversify from bonds, stock, and cash. The daily value of your real estate correlates very little to stock and bond prices. Like private real estate, alternative lending can be attained via direct loans or a mutual fund.

- Alternative lending – Endless individuals and institutions are looking to borrow money from non-traditional sources like banks. One or more short-term assets usually collateralize these loans. The collateral acts as a parachute if the borrower cannot satisfy the loan termsConsumer spending dwindles since Examples of alternative lending include private real estate loans and peer-to-peer lending.

- Options and derivatives – Options are contracts to buy or sell agreed-upon products in the future. They can be purchased for stocks or other assets or used to hedge a position you already hold (or hedge against stock market moves in the future).

Derivatives are contracts based on features and movements of assets. Values of the assets determine them. Stock options are just one type of derivative. Other derivatives are based on stock averages, currencies, mortgages, and other financial assets.

Alternative investments can complicate and cost you if done without professional help.

Strategies for Affluent Investors: Can You Win During Inflationary Times?

It’s no secret that high-net-worth investors allocate money to many favorite investments to protect against inflation.

Invest in Consumer Staples

One of these avenues is investments in consumer staples. What are we, the people buying? Consumer staple stocks represent noncyclical companies that sell or produce services or goods in demand 24-7. Because of the consistency, the consumer staple sector is an investor haven during a recession.

This is an excellent option for investors seeking consistent growth, solid dividends, and low volatility.

ETFs Keep it Simple

High-net-worth investors seem to favor the lower-volatile Exchange-Traded Fund (ETF) as a colossal portfolio asset. These simple products are designed to match the performance of benchmarks. Indexes such as TSX 60 or the S&P 500 offer lower fees than one would pay for units in mutual funds (a similar objective).

Keep in mind – they aren’t doing it alone. High-net-worth individuals are usually using a full-service financial firm.

Retail Slows In Recessionary Time

Even though retail stocks are more volatile in nature, high-net-worth investors often opt-in on this sector during a recession. This performance-based stock is measured on return on revenues (ROR), return on invested capital (RIOC), return on total assets (ROTA, and return on capital employed (ROCE).

Since retailers are immediately impacted by an economic downturn, forced to cut budgets, and lay off workers, consumer spending dwindles.

Real Estate Stability

The triple-net lease sector has proven resilience, as it provides stability during uncertainty, making it an attractive choice for wealthy investors. In short, NNN offers longer-term leases with creditworthy tenants.

Now (during a recession) is a great time to move towards triple-net lease space to secure competitive financing terms.

Inflation – Why Do Prices Keep Going Up?

Inflation inferno

Inflation inferno

During a recession, the response is to dig us out, right? In doing so, the money supply increases while the value of money decreases, causing inflation. To help counteract, the Fed uses tactics and programs to combat inflation. Thus, the term “inflation inferno” was coined, and we are still in the thick of it.

Supply chain

As you know, industries set their prices to maximize profit. They rely on goods and services needed for production, like raw materials, technology or machinery, and storage and transportation.

When these costs rise, industries must raise prices. Then sectors raise prices, raising costs for the sectors they supply. Do you see the chain? This, too, is due to the recession.

Labor shortages

The demand for workers is resolved, but sadly the number of workers willing to accept positions has not.

From restaurants to factories and assembly lines, people on unemployment is higher. Could this be that after COVID-19 layoffs, people were paid enough to get by? Were the stimulus checks over the top?

Over 1.5 million more are retired than expected pre-pandemic, and millions fewer 45+ are working or want to work.

Government spending

Government spending and tax policies used to influence the economy is referred to as fiscal policy. It’s their responsibility to stabilize the business cycle and regulate economic output, right?

During a recession, the government usually employs expansionary fiscal policy by lowering tax rates. This increases aggregate demand and fuels consumer spending. When expansionary symptoms such as inflation occur, the Fed usually enacts contractionary fiscal policy.

Do you think our government is spending wisely to get us out of this mess? You must take it upon yourself with your savvy financial advocate to balance your wealth.

Biggest hit to small businesses

We like to think that Uncle Sam has a soft spot for mom and pop to help them not close up shop while working overtime to get by. Sadly, small businesses that aren’t investing in financial and equity markets are less likely to receive government bailouts, loans, and other benefits.

Bankruptcies among smaller businesses typically occur higher than among larger firms. Again, all the more reason for small business owners to reach out for financial planning support.

Lay the Groundwork for Tax Savings in 2022

One of our mottos: A Failure to Plan is a Plan to Fail.

Taxes: The Unexpected Retirement Killer (5 Strategies to Keep Your Wealth)

Tax-efficient Investing

The tax scenario may change but for now, put your pre-tax money to work by looking for tax-efficient investments. Knowing what to invest in is the golden ticket. Working with a professional is essential to align your goals with strategies to get you there.

Minimize your tax burden and maximize your bottom line with tax-efficient investing. This endeavor is significant for high-net-worth households. Your ability to use taxable vs. nontaxable accounts wisely will dictate success.

Tax-efficient investments should be made in taxable accounts. Investments that aren’t could be made in tax-exempt or tax-deferred accounts. Tax-advantaged accounts such as IRAs and 401(k)s have annual contribution limits.

Municipal Bonds (munis) serve as an outlet to preserve capital while you generate a tax-free income stream. These debt obligations are loans to the issuer in exchange for interest payments over a set amount of time. The total amount of your original investment is returned after the bond reaches fulfillment.

More of your money is available to earn a return without the effect of taxes. You can trade securities inside nontaxable accounts without paying taxes on gains. Reach out to a high-net-worth financial advisor to help you make a trade within accounts.

Is Cryptocurrency a Legitimate Hedge Against Inflation?

How risk-averse are you?

If you’re reluctant to take risks, high-risk investments might not be right for you. These gambles have high probability of value decline in which you can lose money. A modern high-risk investment includes cryptocurrency.

Risk equals price volatility in the investing world. So any volatile asset is not suited for the risk-averse investor. Even those with high-risk tolerance still do not prefer to invest in cryptocurrency.

What is crypto? How does it work? And why is it not a good idea?

Although crypto has been increasingly popular and recent commercials featuring movie stars might spark hope of a promising future, banks find that Bitcoin for example has not proven to be a strong inflation hedge. Of course, there are endless types of cryptocurrency now.

This modern digital currency provides verified and recorded transactions that are maintained by a decentralized system using cryptography, rather than a centralized bank. This makes it unregulated, which is why the government and many financial advisors are skeptical of its value.

Commodities and even equities hold better in times of inflation. It seems that crypto is the opposite of diversification, declining volatility, and inflation protection.

A volatile asset, it’s also unregulated and dangerously speculative. Why are more investors not questioning its ability to protect against rising inflation?

As a global source of money, the bank of England warns that Bitcoin Could Become Worthless. The deputy governor, Sir Jon Cunliffe, told the BBC that the bank needed to be prepared for risks linked to the crypto asset rise following its rapid growth. “Their price can vary quite considerably and [bitcoins] could theoretically or practically drop to zero.”

Revenue Opportunities from Concentrated Stock Positions

This is one of our specialties at Watts Gwilliam and Company: putting concentrated stocks to work for our clients. Our dedicated financial advisors help you turn these assets into income generators.

Read: How to Turn Concentrated Stock Holdings into Income Generators

“Concentrated equity” (generally speaking) refers to having at least 10% – 20% of your wealth in one stock. And like all else, it depends on your financial goals and asset allocation.

This type of volatility adds significant risk to your portfolio. It puts your family’s future financial security at risk and can lead to major tax and liquidity issues if you ever need to sell. If you’re in a position where major dips and swings in company stock would cause you to delay your retirement, it’s time to rethink.

Let us help you determine how risk-averse you are in order to turn obstacles into opportunities.

Watts has the OPTIC Program (Options for Income Creation)

Using our OPTIC program, you can:

- Generate an ongoing income stream

- Continue to receive dividends and maintain voting rights

- Participate in some of the upside appreciation if price rises

- Hedge your downside exposure through additional income

A conservative way to generate income is writing call options, called “covered calls” against a position. In exchange for a cash payment, you can sell/”write” options on your stock position. Often the option expires worthless, and you get to pocket the premium.

With this repeated process it’s possible to generate an ongoing cash flow. It requires a significant amount of work to analyze, purchase, and monitor the options manually. Our proprietary computer model helps ensure that all options are written according to the parameters you set.

The OPTIC Program is right for you if:

- You have a concentrated stock position that meets a minimum requirement of the lesser of 10,000 shares or $500,000 market value

- You’re looking to generate income off the concentrated stock position

- You’re comfortable either selling all or a portion of the position or speculating on the stock remaining under a target price

Inflation inferno

Inflation inferno